He has an inside knowledge of how the financial markets work, thanks to roles including trader on a $750m Event-Arbitrage desk and CRO and COO of hedge funds running a variety of strategies. From stat-arb and trend-following CTA to fixed-income relative value. Firm’s he has worked at include big banks like Citi, and prominent hedge funds including D. The platform provided by FXTM is the most popular forex trading platform in the world, MetaTrader’s MT4. As a third-party agent provides this software, registering for an account and downloading the platform requires new users to agree to licence agreements with MetaTrader.

However, if you are new to trading then there is plenty to get your teeth stuck into. The broker provides you with a free Currency Convertor tool for you to be able to quickly calculate the foreign exchange rates of major FX currency pairs. I was induced to pay $6,300, and we started trading for more than a month, until the amount reached 36,893. The so-called Dr. Ali Saleh withdrew the full amount and changed the username and password….

What is FXTM leverage?

Whether you’re looking to trade in FXTM crypto, or you’re hoping to avoid any potential FXTM scams, we’ve got all the info you need to know. Come and check out our FXTM review to find out all about the broker, and discover whether it could be your new perfect trading partner. As part of our FXTM review we took a look at the company’s history, and we’re happy to reassure you that this is no fly-by-night operation!

- The new FXTM accounts being set up far sooner than the official T&Cs state might be the case.

- Since the product and services portfolio at FXTM remains well-explained, I doubt most traders will require assistance.

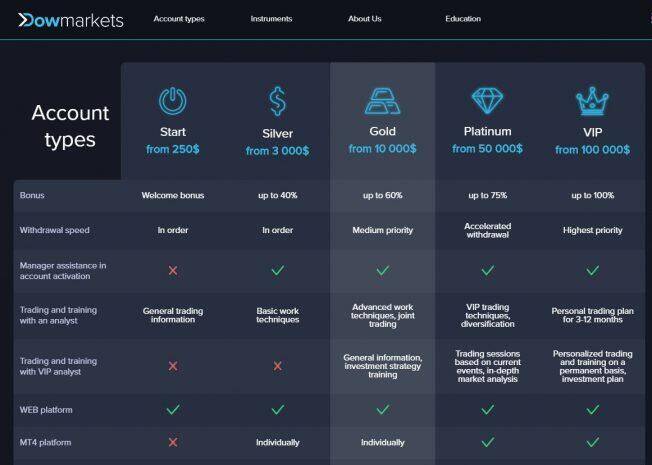

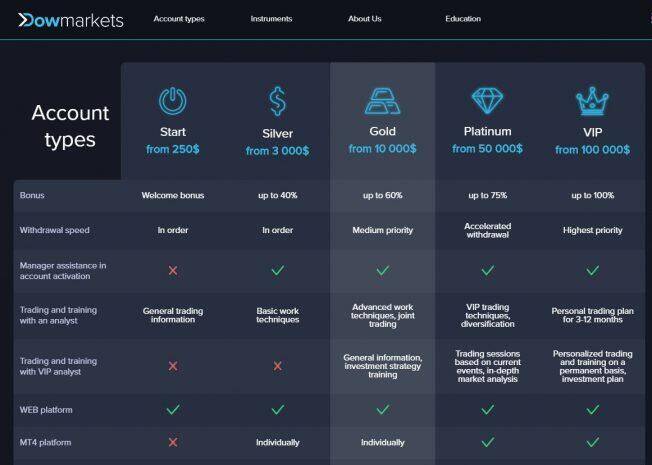

- Each account type comes with its own unique features, including different leverage options, spreads, and minimum deposit requirements.

- Be careful with forex and CFD trading, as preset leverage levels may be too high.

- No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services.

- FXTM is regulated by several financial authorities and customer service is offered in several languages.

Trading leveraged products may not be suitable for all investors. Trading non-leveraged products such as stocks also involves risk as the value of a stock can fall as well as rise, which could mean getting back less than you originally put in. We found that FXTM’s customer support is excellent compared to other similar brokers with weekend support. We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading within about 24 hours. FXTM also has its own trading app that integrates well with MT4, but we were disappointed that it does not support MT5 or investment accounts. Leverage is offered based on your country of residence, knowledge and experience.

Spreads and commissions

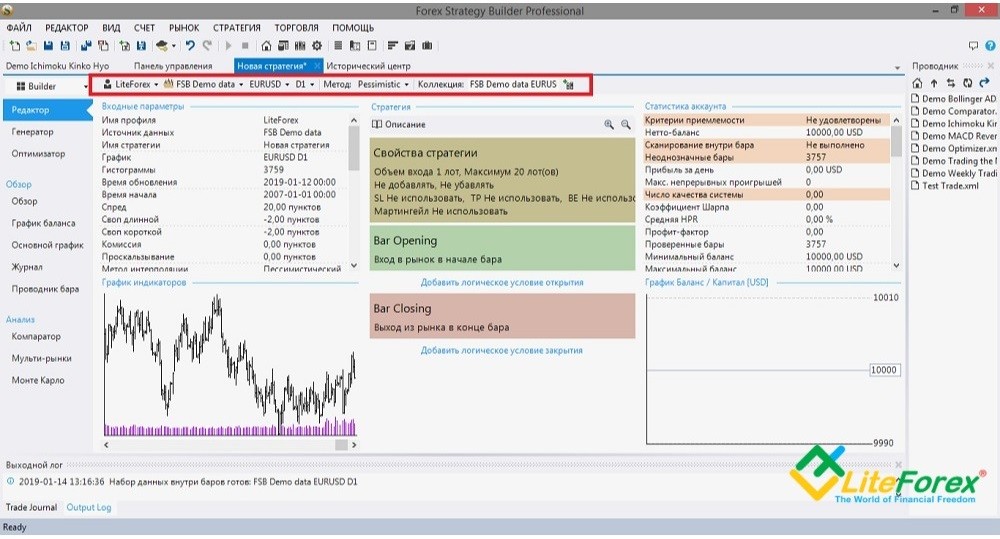

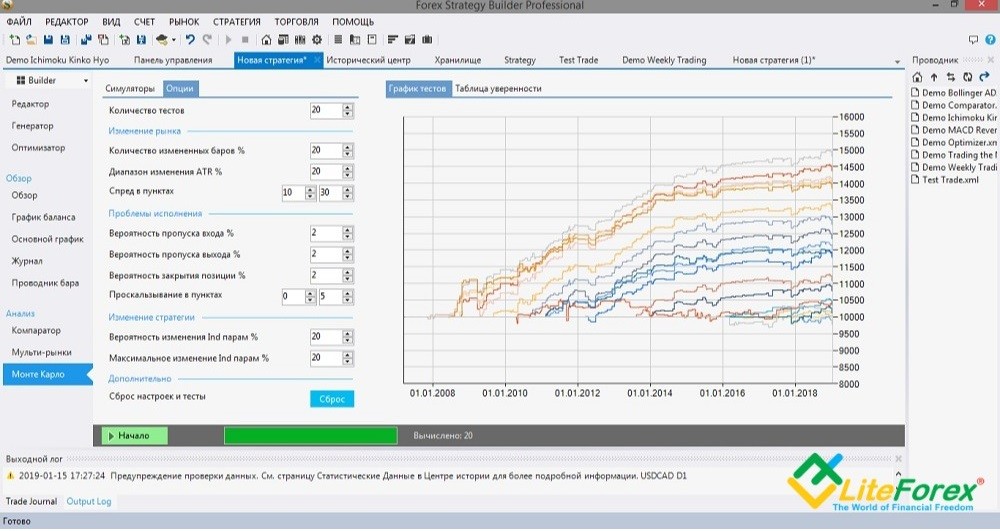

FXTM shines in the area of market analysis, with an in-house team producing insightful articles daily. Content covers fundamental and technical analysis and is mainly focused on the forex market. FXTM offers MetaTrader 4 for desktop, which includes advanced functions such as copy trading and automated trading. Spreads and commissions are outlined on the Account Comparison page. The Client Agreement can be found on the Account Opening Agreements page.

ForexTime FXTM review: Could this be the best forex trading tool? – TechRadar

ForexTime FXTM review: Could this be the best forex trading tool?.

Posted: Fri, 15 May 2020 07:00:00 GMT [source]

The only point is that regulatory standards and protection vary based on the entity. FXTM Overall Ranking is 9.3 out of 10 based on our testingand compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers. For the Cons, there is a withdrawal fee, and Stock spreads are rather higher, also condiitons vary on each entity.

Review Methodology

The methods for withdrawal are nearly identical, with a few differences. You can withdraw, for example, via China Union Pay and cannot withdraw via Alfa-Click or Cash U. Most withdrawal processing times are 24 hours with the exception of China Online Banking which takes 48 hours. You can view the specific floating commission rates under Trading Accounts on the Commissions page. You will also find commissions for stock trading via PRO MT5 here. There is fast execution and the availability of micro and mini lots. With FXTM, traders are able to trade a nice range of instruments.

Week Ahead: USD/JPY to Feel the Love This Valentine’s Day? – FX Empire

Week Ahead: USD/JPY to Feel the Love This Valentine’s Day?.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

They manipulate your trades to make sure you lose, they charge you for any single day you did not trade, you can NEVER withdraw money from fxtm platform. Please read FXTM Reviews below and share live trading experiences with this broker. No, FXTM or ForexTime Ltd is not regulated in the United States of America.

The available stock markets are NYSE, NASDAQ and the Hong Kong Stock Exchange. FXTM hasclear portfolio and fee reports.You can easily see your profit-loss balance and the commissions you paid. Spot Metals – Customers who wish to diversify their portfolio can trade precious metals such as gold and silver directly on FXTM. The parent company of FXTM, Exinity Limited, is licensed and regulated by the Financial Services Commission of Mauritius.

ForexTime also offers regular workshops and seminars for its clients. These take place around the world, with each telling you the language, location, and topic of the seminar or workshop. When trading with ForexTime on MT4, you can also take advantage of various trading indicators. These include an Orders Indicator, Pip Value Calculator, Pivots SR Levels, Spread Indicator, Market Data to CSV, and Day Bar Info Indicator.

Do not use ForexTime to Trade!!!!!

They also provided links and extra reading material where appropriate. Like other well-regulated brokers, FXTM does not allow funding to or from third parties. No matter your deposit method, the withdrawal of all profits must be made by bank transfer to a bank account in your name. Our testing team chose the phone call-back option as not many other brokers offer that service. A representative from FXTM typically responded to the request within approximately 60 seconds.

https://traderoom.info/ has been in the market since 2011 and we have more than 4 million clients trading with us. We are also strictly monitored & regulated by several international jurisdictions. Keeping these in mind, it is practically impossible for FXTM to manipulate or interfere with the trades of our clients since we are answerable for every trade & transaction. From news flow to technical analysis-based trading ideas, FXTM offers a lot of research tools. FXTM’s forex product selection lags behind some of its competitors. This holds for the stock index and commodity CFD product offering as well, while the number of stock CFDs is low compared to competitors.

FXTM is relatively strong in the number of available CFDs on indices and the variety of major, minor and exotic currency pairs. The Micro account offers average spreads for the industry, while the Advantage account offers more competitive spreads but also charges commissions. Established in 2011, FXTM is a global forex and CFD broker headquartered in Limassol, Cyprus. FXTM offers trading in forex and CFDs on commodities and indices via the MetaTrader platform and the FXTM Trader App.

There have been cases where even fxtm broker reviews Forex brokers have purposefully indulged in fraudulent activities to make quick profits. Regardless of all the negative experiences, there are a few Forex brokerages such as FXTM, which aims to create a secure trading environment for retail traders. FXTM does offer a free demo trading account for beginners to practice forex trading in a 100% risk-free environment. FXTM does offer an Islamic, Swap-Free account option and Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries. FXTM makes three live trading accounts available, the Micro account, Advantage and Advantage Plus Accounts.

In the review, we have tested theECNandStock CFDs MT4 accounts. Since our testing these platforms have been renamed to Advantage Account. Click here to see a detailed table in the Deposit and Withdrawal chapter. If you are a non-EU client, you can also trade commission free with real stocks from the NYSE and NASDAQ stock exchanges.

- Exinity Group has announced that it has obtained a license from Kenya’s Capital Markets Authority to operate as a regulated non-dealing forex broker.

- FXTM is regulated by several financial authorities, including the UK Financial Conduct Authority and the Cyprus Securities and Exchange Commission .

- Trading FX or CFDs on leverage is high risk and your losses could exceed deposits.

- To assist with the decision, ForexTime displays the live rankings for top performers, with all the data verified by PwC.

- MetaTrader is also popular due to its copy trading and automated trading features.

FXTM invest is an interesting addition for copy trading ( this isn’t available in the UK though) which not a lot of brokers, apart from eToro, include in their offering. This allows you to invest in a trader of your choosing and take a share of any profits they manage to generate. There are also forex trading strategies, forex trading videos, general forex educational videos, and educational articles. Clients can also find tutorials on a range of subjects, and a periodic table with investment terms.

FXTM Broker Review – Broker with a wide range of asset classes

The Forex broker provides access to trading 19 Major pairs such as AUD/JPY, AUD/USD, EUR/USD, USD/CAD, USD/JPY, and more. Major currency pairs are backed by strong economies and are more stable compared to exotic currencies. Retail traders, institutional traders, governments, international companies, and banks are exchanging more major currencies than exotic ones in the Forex market. As a result, liquidity is increased and spreads are decreased.

Theminimum depositamount required to register anFXTMlive trading account ranges from $10 USD – $500 USD. Overall, FXTM can be summarised as a trustworthy broker that provides Contracts for Difference and low spreads on 250+ trading instruments. FXTM is regulated by one tier-1 regulator , two tier-2 regulators , and one tier-3 regulator. FXTM does not have their own propriety trading platform, instead choosing to provide MetaTrader 4 & 5 as options.

However, only 10 lucky winners will be chosen to win this promotion. This is not the real FXTM website… I have been trade with them on and off for 5 years. I have an account with Jimmy French and done the same.He lock my account and ask for 1200 to open it and I gave him the money now he wants 5k to realize the money I have in my account. In terms of funding methods, FXTM offers numerous payment methods which are a very good plus, yet check according to its regulation whether the method is available or not. These may include residential proof, a copy of your ID, a bank statement, etc. The main entity ForexTime Ltd is regulated by CySEC of Cyprus, authorized by FSCA of South Africa, and by additional offshore authority FSC in Mauritius.

EUR/USD H4: Bears Ready to Pounce If Bulls Fail to Breach Key Resistance – FX Empire

EUR/USD H4: Bears Ready to Pounce If Bulls Fail to Breach Key Resistance.

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid. FOREX.com, registered with the Commodity Futures Trading Commission , lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade.