Bitit Overview & Pricing

Contents:

Finally, about the cash advance fee, it’s a fee charged by your bank which is considering the transaction as a “money withdraw”, we are not responsible for such fee. Please do not hesitate to contact our support team at in order to clarify this issue. Paris-based Bitit is an e-commerce platform that allows users to buy and sellcryptocurrencies. The simple and intuitive interface lets users access Bitcoin, Ethereum and leading cryptocurrencies quickly and safely while using their local currency.

Users can purchase over 25 different currencies and can fund their accounts via wire transfer from almost every Thai bank. With nearly 3 million members, Indodax allows users to trade their favourite cryptocurrencies. Users can fund their account via WeChat Pay, cash deposits or wire transfers from Indonesia banks. Based in Argentina, Ripio allows users to purchase bitcoin, ethereum, DAI and more.

Best Crypto Pairs Trade Idea For 2023: Long GBTC And Short Bitcoin – Seeking Alpha

Best Crypto Pairs Trade Idea For 2023: Long GBTC And Short Bitcoin.

Posted: Thu, 26 Jan 2023 08:00:00 GMT [source]

They have dedicated over-the-counter Trading Desk and SMSF teams to cater for high value traders and institutional investors. Here are some popular exchanges from which to buy crypto in South America. Europe’s premier exchange with one of the largest volumes for BTC-EUR. All you need to get started is a European bank account. Due to massive amount of daily transactions that we are processing this process can take up to 8hours. We are sorry, but your computer or network may be sending automated queries.

Users can easily switch between assets and make purchases with their Bitwala debit card. This Austrian-based exchange provides users with a personal wallet and trading platform. Crypto can be purchased with credit card, debit card, SEPA, Skrill, SOFORT, NETELLER and more. Bitkub was the first exchange to launch a mobile crypto trading app with 24/7 customer support.

How to buy bitcoin in Canada

Discover the most https://forex-reviews.org/ brokers and exchanges from which to buy bitcoin and other cryptocurrencies in your country and region. For more information please read our Terms and Conditions. Was a pain trying to purchase bitcoins but after 2 hours of being on phone with my bank and visa I finally got it through. Was not your fault but Visa acted like they didn’t know what a 3D security was… One of the simplest and easiest exchanges for cryptocurrency – Been in this industry for many years, and I’ve not seen one as fluid as Bitit. From registration/verification to payment to receiving your crypto, it’s all done swiftly without any BS.

BitFlyer’s deep liquidity and low fees ensures customers get fair rates. Bitcoin can be purchased with cash deposits and they also offer fee-free online bank transfers once your identity is verified. Swiss users can make purchases via Bity ATMs or online on their exchange which accepts both EUR and CHF deposits via online bank transfers, wire tranfers and SOFORT.

This FINTRAC registered and PIPEDA compliant platform has no funding and withdrawal fees but charges a 0.5% trading fee. Lowest nightly price found within the past 24 hours based on a 1 night stay for 2 adults. It took a week to get verified, then my account was blocked for 1 unsuccessful payment with my card. I am able to deposit money which I have done, however I am not able to sell my bitcoin and convert it into withdrawable money.

Confusing/faulty selling and withdrawing functions

bitit review To YouEstablished in 2013, they were the first bitcoin broker in Brazil and accept deposits via online bank transfer. Customers from Argentina, Chile, Colombia and Peru can use Buda to purchase crypto. Buda accepts bank transfers in all four countries whilst cash can also be used in Colombia and Peru.

Bitcoin: The Bull Run Is Starting Once Inflation Expectations Turn … – Seeking Alpha

Bitcoin: The Bull Run Is Starting Once Inflation Expectations Turn ….

Posted: Tue, 11 Oct 2022 07:00:00 GMT [source]

Have submitted payment for ETH, however purchase was immediately put on hold. Although currently unable to process Naira deposits due to government restrictions, NairaEx has been in operation since 2015 and remains the most popular exchange in Nigeria. Over 1.7 million people have used Unocoin which charges a 0.7% buy and sell fee and provides access to more than 50 crypto assets.

Users can place deposits via wire transfer from both Thai and non-Thai banks. Local deposits take up to 24 hours whilst international transfer can take up to seven days. This Sydney based exchange has over 150,000 customers from Australia and New Zealand. Bitex is an exchange and broker servicing customers across South America. They accept several methods of payment including cash and AstroPay.

I thank you Bitit.io for your efficient…

Great website/app for buying and/or selling crypto-currencies. It has a wide range of currencies to choose from as well as multiple payment options. This comes with the highest transaction fees of 8.75% and is only available for purchases made using Euros. The buying limit for vouchers is 2,500 Euros per week.

First of all, please accept our apologies if you were not satisfied by our services. The purchase fee with Credit Cards is still higher than some other competitors such as Binance.com (@3.5%), Blackmoon.net (@3%). But support team contacted me and helped me to solve the issue.

- Kuna is the first public crypto exchange in the Ukraine and offers over 30 cryptocurrencies.

- This bitcoin broker allows customers to purchase bitcoin with bank transfer, cash or credit card.

- Have submitted payment for ETH, however purchase was immediately put on hold.

- However, the wire transfer option is only available for purchases made using Euros.

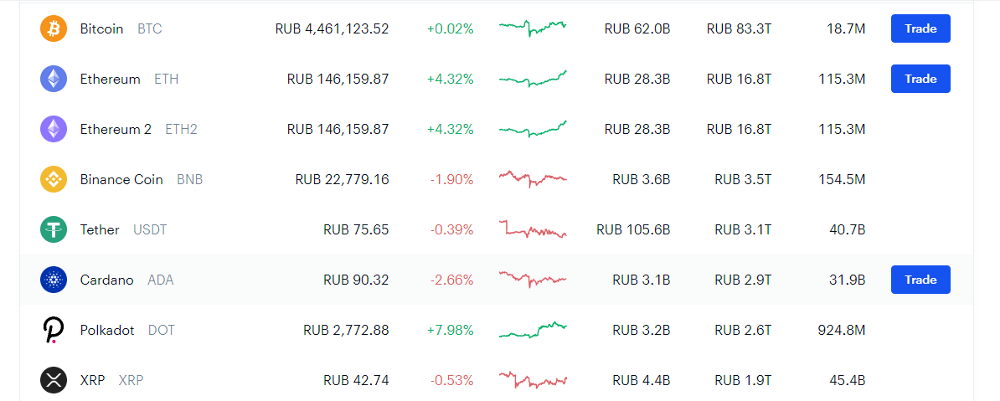

Bitit only allows Visa and MasterCard credit and debit cards. You can use this purchase method to buy cryptocurrency in any of the 15 currencies that Bitit currently supports. There is a buying limit of 7,500 Euros per week if using this option.

The company says it protects user data with the highest security standards to ensure it remains encrypted and confidential. The platform does not store your card number or account password. Bank-level security and two-step login verification further protect accounts from unauthorized access. New Zealand owned and operated, this exchange allows customers to deposit via bank transfer and POLi. This user-friendly platform has fee-free deposits and withdrawals for INR plus a flat trading fee for buy (0.25%) and sell orders (0.15%). This renowned trading platform allows you to trade bitcoin and other cryptocurrencies along with stocks, ETFs and commodities.

The fee is paid to Bitcoin miners who process transactions and secure the network. Fees can vary depending on a variety of factors such as time of day, day of the week and current demand. Founded in Melbourne in 2013, Cointree provides instant access to 130+ cryptocurrencies and allows users to purchase crypto for their SMSFs. Execute private bitcoin transactions with other users who fund their accounts via bank deposit. Founded in 2011, it is one of the largest European marketplaces with nearly 1 million users. This platform enables users to buy bitcoin, ethereum and bitcoin cash via wire transfer.

- This step can take up to 24 hours, and will require copies of an identification document, such as a driver’s licence, passport, or an ID card.

- They accept Interac and wire transfers as well as bitcoin and ethereum deposits.

- ENTERPRISE ACCESS Your entire office will be able to use your search subscription.

- We also ensure all reviews are published without moderation.

- Users can purchase over 25 different currencies and can fund their accounts via wire transfer from almost every Thai bank.

This Brazilian exchange has accounts with four major Brazilian banks enabling fast and cheap inter-bank transfers for customers. Coinsmart allows you to get started by purchasing bitcoin with a credit card or debit card whilst eTransfers of $2000 or more don’t have deposit fees. Located in Toronto, Coinsquare allows you to buy bitcoin with CAD via Interac, Flexepin, money order, bank draft, transfer deposit and credit cards. Kuna is the first public crypto exchange in the Ukraine and offers over 30 cryptocurrencies.

If you wish to cancel your order, send immediately an email to our support team. Our Risk Management Platform evaluates the potential risk of your transaction and decides whether an additional layer of authentication is required. If we decide that the transaction has a higher risk, we’ll send you an email about your transaction on hold.

Coincheck allows users to buy and sell bitcoin and many other cryptocurrencies via bank transfer or credit card. Users can also use the platform to pay bills or earn interest by loaning out their crypto. Geared towards traders, this exchange offers users the chance to deposit funds via credit card and bank transfer.

Bitonic offers a fast and easy way to buy bitcoins via iDEAL, Bancontact, Giropay, or Mybank. You can also make deposits into your Bitonic BL3P exchange account via the bunq app, iDEAL, or SEPA transfer. This innovative platform is both a bank account and bitcoin wallet that charges 1% trading fees.

Users can make deposits at over 8,000 convenience stores in Argentina via EasyPayment and Rapipago as well as via bank transfer, Mercado Pago and Pix. Based in Montreal, Shakepay is a fee-free option for buying crypto. They accept Interac and wire transfers as well as bitcoin and ethereum deposits. Coinhouse has 17 cryptocurrencies on offer and was the first exchange to be registered with the AMF. Methods of payment include credit/debit card, Neosurf and SEPA.