The Fastest-Growing Niche Markets for Accountants

Contents:

This article will look at the benefits of having a specialized niche, how to determine which niche is right for your accounting practice, and 10 interesting niches for accounting firms in 2023. Our niche websites for accounting firms showcase how you are unique and generate more calls from the right type of clients. As the founder and CEO of CountingWorks, Inc, Lee is passionate about helping independent tax and accounting professionals compete in the modern age. From time-saving digital onboarding tools, world-class websites, and outbound marketing campaigns, lee has been developing best-in-class marketing solutions for over twenty years.

Accountants and tax professionals who are seeking a fast-paced environment can opt for the SaaS route. One important element of this type of growth is choosing a niche for your accounting firm. In this post, we’ll cover what a niche is, why you should consider choosing one, and which ones have the greatest competitive advantage.

- As long as you have the fundamentals of bookkeeping down and a willingness to learn, you can succeed in any industry or business type.

- Your job could have been as a bookkeeper or not, but consider the experience you have.

- When looking at accounting niche’s people usually specialize in one of the following areas.

- But if you offer at a lower rate and then have them recommend you to others, you’ll get a lot of clients to make up the difference.

I also know law, which can be hard to find, and e-commerce and condominium . 10 tactics you can use to set up and manage a competitive Facebook Ads campaign for your financial services company. We’ll entice customers to sign up for a custom email marketing drip campaign. You’ll be able to educate them on your services and obtain their contact information to add to your sales pipeline.

What is General Practice Accounting?

You can choose specific franchises, brokerages, or association members. Plus, you’ll get my weekly Top 5 email curating helpful, innovative content for your modern firm. Certain areas have large groupings of certain industries, like Silicon Valley for tech and software.

“Our firm was able to bring in a new client from the niche website within 2 weeks of it going live. I couldn’t be more pleased with the quality of the website and the great customer service I received.” Through our specialized focus, Neovision understands the complexities and nuances of each of them. We have developed industry leading systems and tools that are simple, affordable and available nationwide. The food, restaurant, and service industries continue to face major changes in relation to a global pandemic, inflation, and supply shortages. Good financial skills are needed now, more than ever, particularly as food service providers look to stay in business. Accountants can provide knowledgeable and skilled advice to buyers, sellers, and real estate or mortgage agents.

The riches are in the niches for accountants and bookkeepers

A guide to help you work through the big decisions around starting a bookkeeping business. You need to nail down what services you’ll offer, who to, and how. Xero does not provide accounting, tax, business or legal advice.

Industry experts project the industry’s size will triple between 2020 and 2025. What was once an all-cash business has become mainstream and, as with any mainstream business, needs accounting support to comply with accounting and tax regulations. To differentiate yourself in the marketplace, consider specializing in a specific type of restaurant or cuisine. Though the accounting doesn’t change between types of restaurants, it gives you a chance to stand out in the marketplace.

26 Great Business Ideas to Start in 2023 – Business News Daily

26 Great Business Ideas to Start in 2023.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

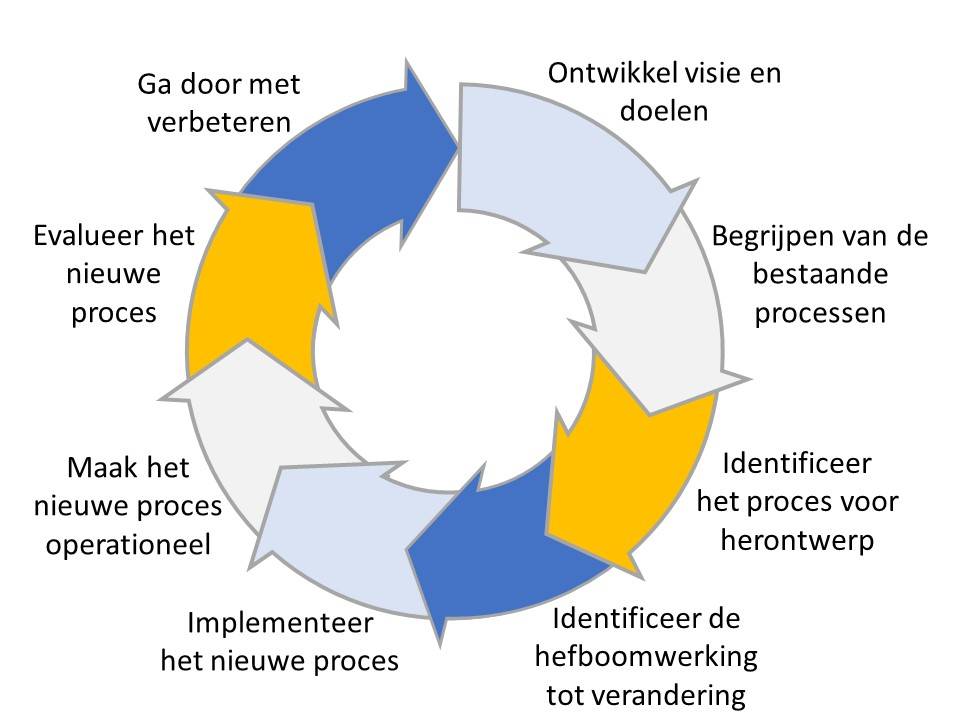

We’ll teach you how to start writing a value proposition and create a niche marketing strategy in this post. Even though a tax and accounting services niche provides room to grow, it’s not always easy to pick and choose. Here are a few mistakes to avoid when picking a speciality accounting area for your business. But in reality, accountants and tax professionals who operate a successful practice within a given niche find extra freedom, flexibility, and growth in their speciality.

How to Niche (Find Your Ideal Client)

All of Build Your Firm’s websites are built fully Search Engine Optimized – No Extra Fees. We are the only website developer in the industry to offer a money back guarantee. As a result of the COVID-19 pandemic, medical providers and healthcare systems have a tangible need for reliable accounting assistance. Growing investments, modernization, and mobilization have contributed to the sharp increase in financial needs for medical providers.

Netsuite vs QuickBooks Top Accounting Software 2022 – Small Business Computing

Netsuite vs QuickBooks Top Accounting Software 2022.

Posted: Thu, 23 Sep 2021 07:00:00 GMT [source]

Independent physicians, hospital-based physician groups, and other medical practice owners are often so busy serving patients that they don’t have the time to properly maintain their accounting. Law firms deal with massive levels of compliance and regulatory issues. Trust is a big deal, and specializing in the specific needs of law practices helps build trust faster. These issues make legal professionals a great niche since they understand the need for specialized services.

This means that your client doesn’t have to juggle multiple service providers around their already busy schedule. Let’s go over the 10 best niches for accounting and bookkeeping firms, as well as what you need to do to ensure your success breaking into one. We know that we need to position ourselves as experts at serving a particular type of client or providing a specific type of service, but picking a niche can be difficult. No matter which method you choose, there is undoubtedly a benefit for specializing and finding the accounting niche your firm needs to carve out your firm’s space in the industry. Discovering an accounting niche can be the next thing your firm needs to achieve new levels of success.

– Niche Facebook & LinkedIn Lead Magnet Ads

This website and the franchise sales information on this site do not constitute an offer to sell a franchise. The offer of a franchise can only be made through the delivery of a franchise disclosure document. Certain states require that we register the franchise disclosure document in those states. The communications on this website are not directed by us to the residents of any of those states. Going with a franchise means you can go with a business structure that already works.

It’s impossible to become an expert in every industry, and it’s ineffective to provide one-size-fits-all advice and general accounting services to every client. Businesses who offer niche services may serve a smaller slice of the market, but they serve them better. When we’re talking about money, people want to know they’re in expert hands. An accountant who knows all the ins and outs of a particular field— its rules and regulations, its special exceptions, its insider jargon — is worth their weight in gold, and potential clients know it. This is why advisory services are a HOT transformational accounting niche in 2021.

Besides the psychological advantages, you’ll see that there’s also a financial advantage. I recommend using a responsive search ad with a goal of either conversions, target conversion cost or ROAS . If you used a phrase match of “accounting websites,” your ad would probably show up for “website training” and “accounting courses” if you’re not careful. When you create your ad, you should use a dynamic search ad and also do a little homework with an SEO keyword tool or the keyword planner within Google ads. Bookkeeping is a a specialised area of accounting that requires a unique set of skills and knowledge. Niching by industry is usually what first comes to mind when it comes to bookkeeping.

Attract Qualified Leads to Your Bookkeeping Business by Targeting a Niche Industry

This niche may work especially well for a virtual accounting firm since the businesses are also accustomed to doing business virtually. With the IRS and bank regulations playing catch up to this newly regulated field, there’s growth available for an accountant who knows the industry well and provides top-notch service. Local businesses can have differing budgets, so consider that when choosing your niche. If you want to make more, you can focus on established businesses with more funds to pay a bookkeeper. Construction and trades are also very popular businesses, and you can find them anywhere.

We’ll create a custom email marketing drip campaign to provide value to your audience and to draw them into your website to learn more. We’ll work together to answer these questions and lay the foundation for a successful marketing campaign. We will update your website or create a landing page with specific content focused on your niche and showcasing your value proposition. It’s the reason why people work with your bookkeeping business and not your competitors. Schedule a strategy call today and start growing your business. You have to put in more time and money, but sometimes a Niche will want to see content specifically for them.

Not-for-profit double entry accounting are another powerful niche required to document and report details on finances. It’s also a decent-sized niche with religious, social, and a number of other entity types, all falling under NFP status. Real estate has its ups and downs, in a long enough timeframe.

- Yes, you can absolutely get more clients by having a QuickBooks Online niche, and not just QuickBooks Online but very specific QuickBooks Online niches.

- They’re delivering tailored content on how to file taxes, crypto accounting software, and other key terms crypto buyers are searching for.

- Local bookkeeping can be a great niche in a small town, but you can do it in a city.

- As the industry progresses, serving a specific area can help your firm make a local community impact and provide services to underserved communities.

Develop a crystal clear understanding of your ideal clients’ problems and pain points. As self-employed accountants and tax professionals, we often hear about the importance of picking a niche to specialize in. Join the community The world’s largest online community of accountants and bookkeepers.